Feb 9, 2026

Metal Workflows: Better Organization, Faster Access, Greater Scale

James O'Dwyer

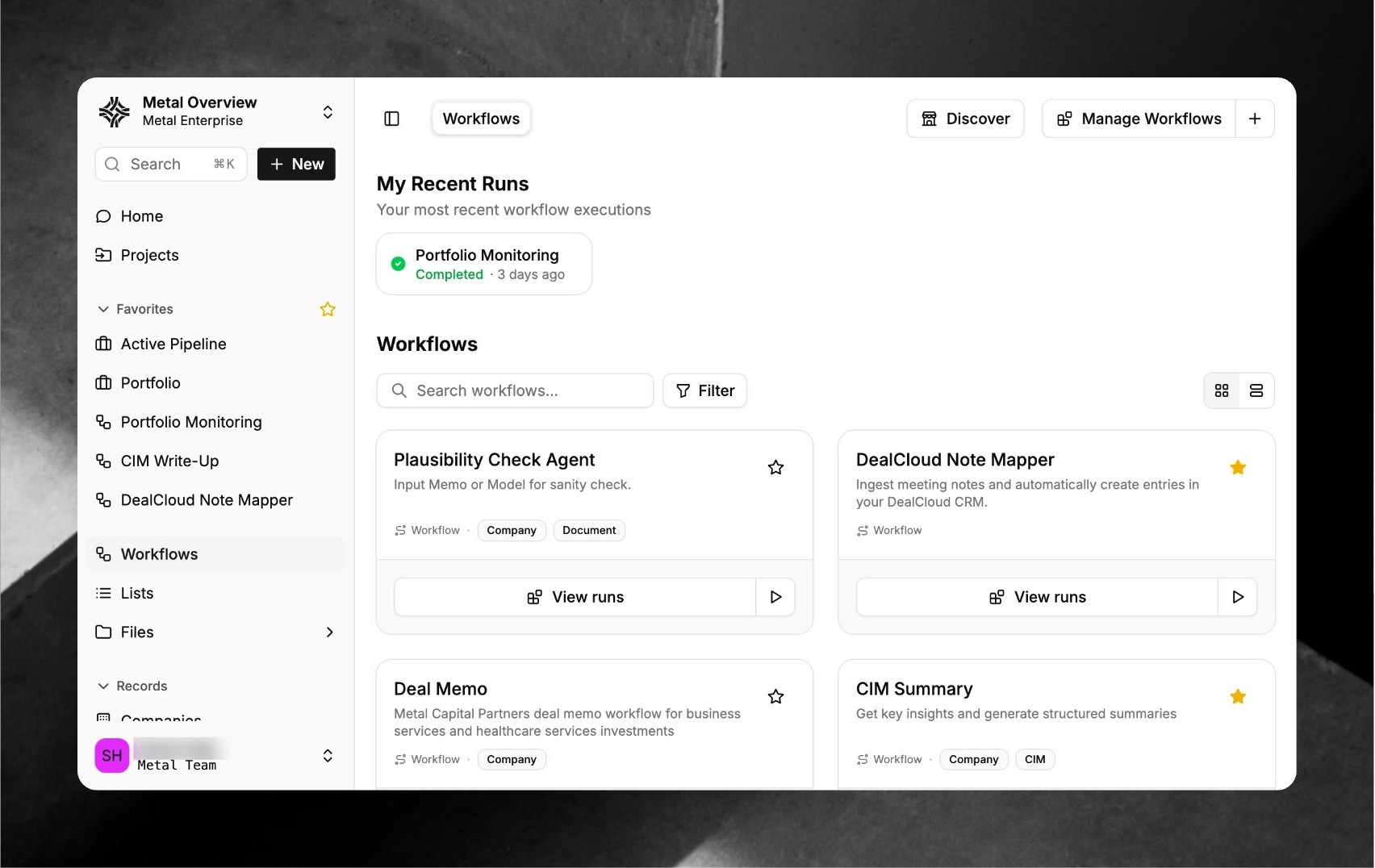

Metal Workflows launched last October. By Q4 2025, adoption reached 40+ average workflow runs per user.

Thanks to clients who've been true design partners, Metal has built dozens of custom AI workflows—from target sourcing and screening to opportunity scoring, due diligence, and portfolio company value creation. The adoption validated our thesis. The feedback sharpened our roadmap.

Today, we're announcing a major upgrade designed to help private equity deal teams manage AI-powered workflows at scale. Better organization, lower operational overhead. Because every second spent searching for the right workflow is a second not spent on deal evaluation.

What’s New

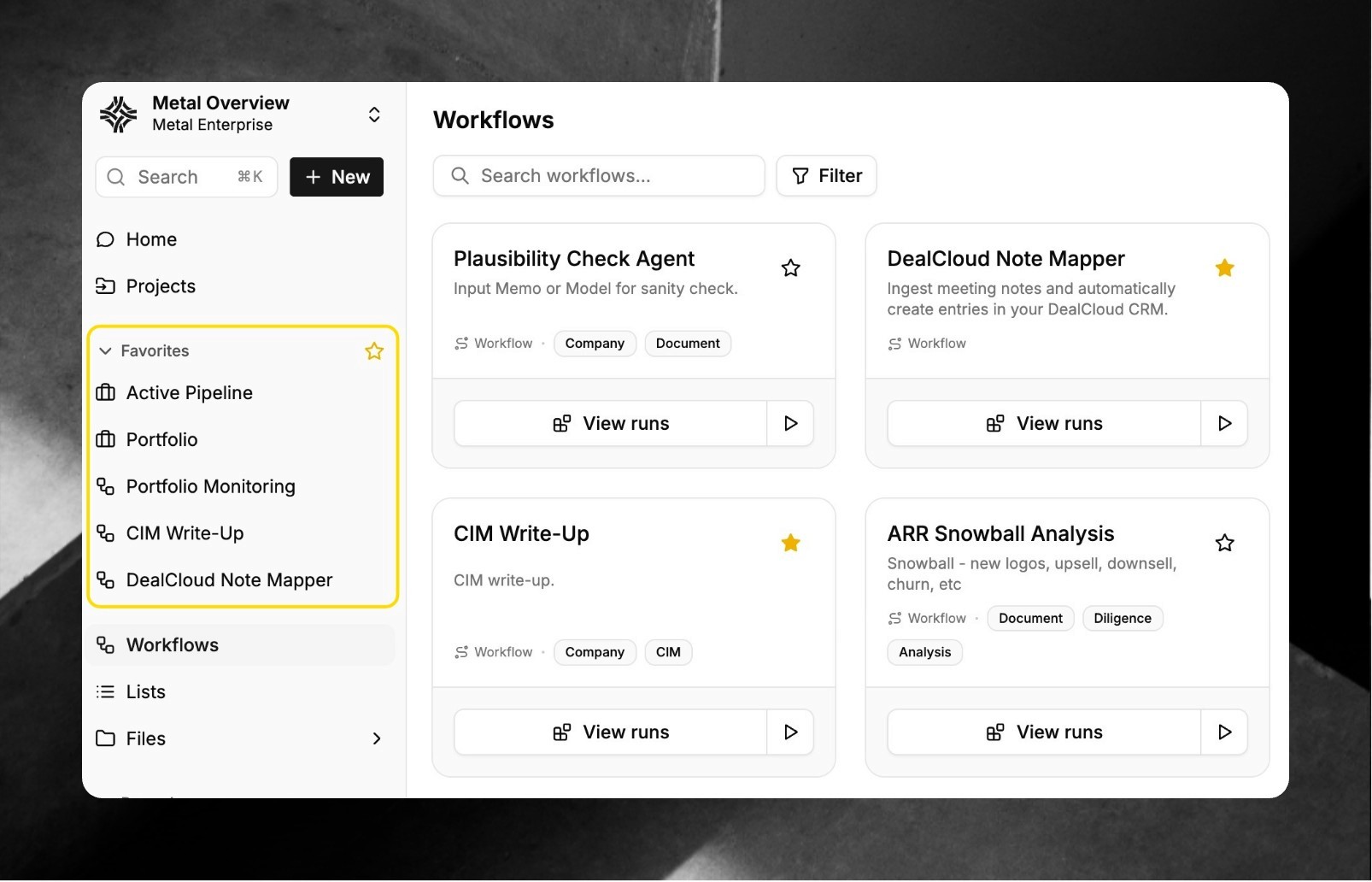

Update 1: Favorite Your Most Critical Workflows

With Workflow 2.0, users can now mark any workflow as a Favorite to quickly access them from the sidebar. This reduces the cognitive load that accumulates when teams operate at scale.

What this means in practice:

Your go-to CIM Scoring workflow is always one click away, not buried in a list of 25 options.

Analysts see only the workflows relevant to their current deal stage, reducing errors and onboarding friction.

Partners can pin high-priority workflows during active deals, then unpin when the deal closes.

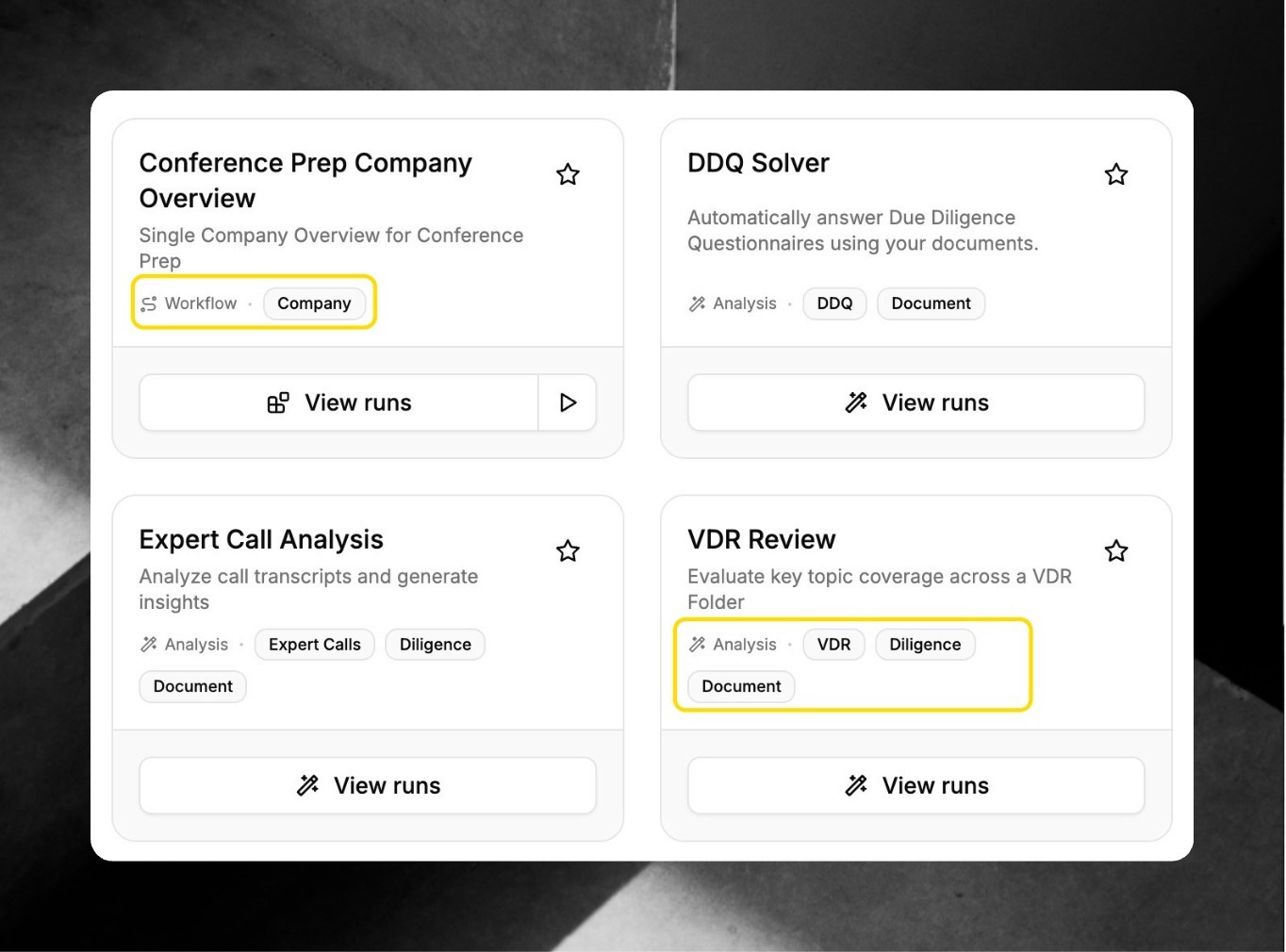

Update 2: Tag Filtering

The new tagging system introduces structured organization that matches how deal teams actually work.

Users can assign multiple tags to any workflow, then filter, search, and surface the right workflow in seconds.

A single workflow can carry multiple tags:

By deal lifecycle:

Diligence|Screening|Investor RelationsBy Inputs:

List|Company|DocumentBy type:

Workflow|Analysis

From AI Workflows to Institutional Intelligence

Workflows are one of Metal's most powerful features and they don't exist in isolation. Their power comes from what sits beneath them: Metal's unified data infrastructure, a true system of record that captures, connects, and structures your firm's entire deal history.

This foundation is what makes workflows intelligent rather than just automated. Every CIM score, every expert call analyzed, every VDR reviewed flows back into your institutional library, compounding knowledge that informs the next deal, and the one after that.

Our goal as a technology partner to private equity is to help firms reimagine how they operate and scale. See our partnership approach.

When workflows run on unified intelligence, teams move faster. More importantly, they move with greater conviction.