Oct 14, 2025

Partnership-Driven AI: How Metal Empowers PE Firms

Taylor Lowe

Why Partnership Matters in Private Equity

For your fund, adopting AI isn't just a technology decision. It's an operational and cultural transformation that touches every aspect of how you evaluate, execute, and manage investments.

Our philosophy at Metal is straightforward: effective AI transformation is best achieved through collaborative partnership with a purpose-built team, not by choosing software features.

This is why Metal is more than a SaaS platform. We are a true technology partner built to support you at every step of your AI journey.

Most providers ask about your AI objectives. We ask about your fund objectives. By deeply embedding into your team’s workflows, aligning with your investment mandates, and evolving with your priorities, we avoid the pitfalls that sink most enterprise AI initiatives. Our tools learn, retain context, and integrate into real-world decision-making.

Case Studies: Partnership in Action

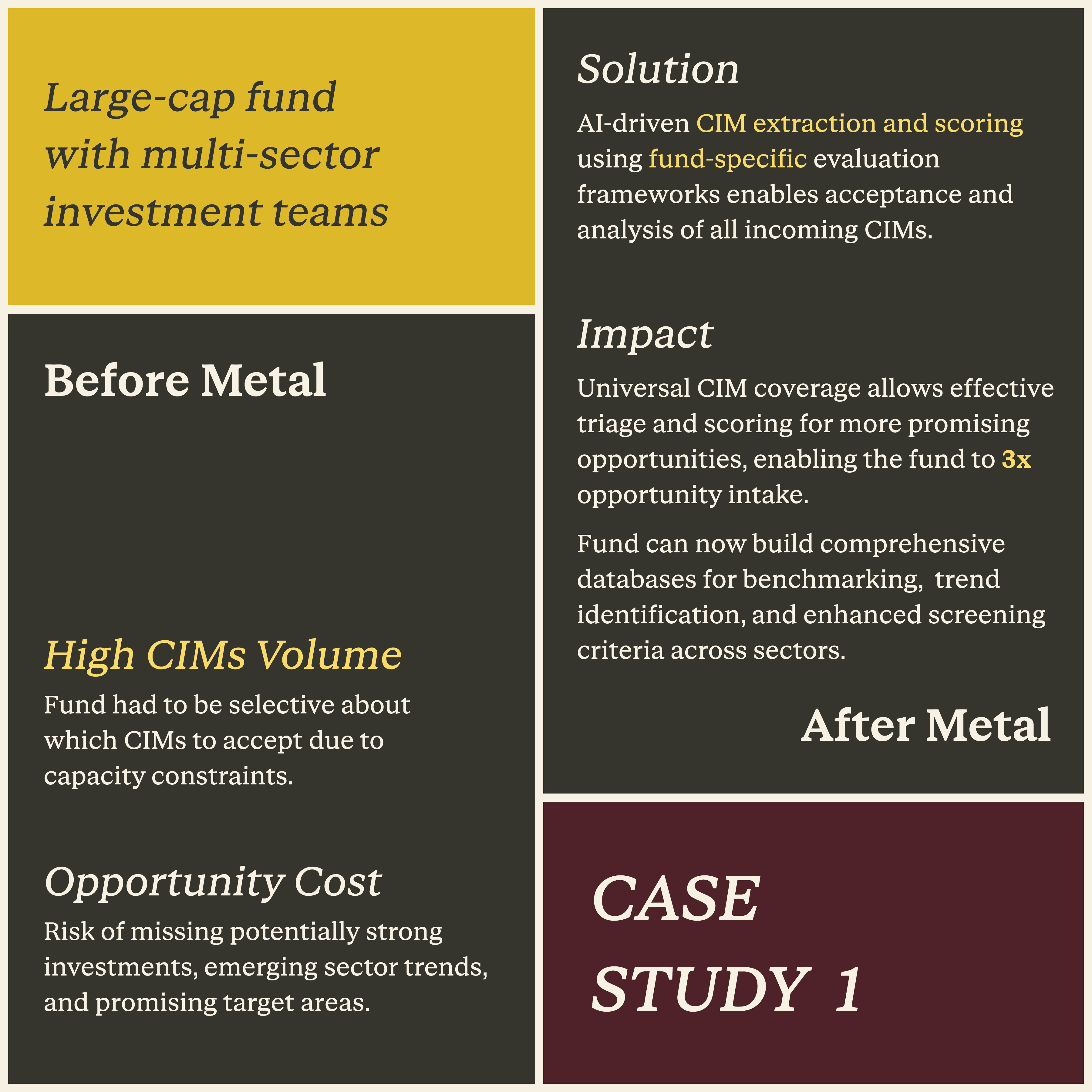

Case 1: Large-Cap, Multi-Sector PE Fund Automated CIM Processing to Scale Deal Flow

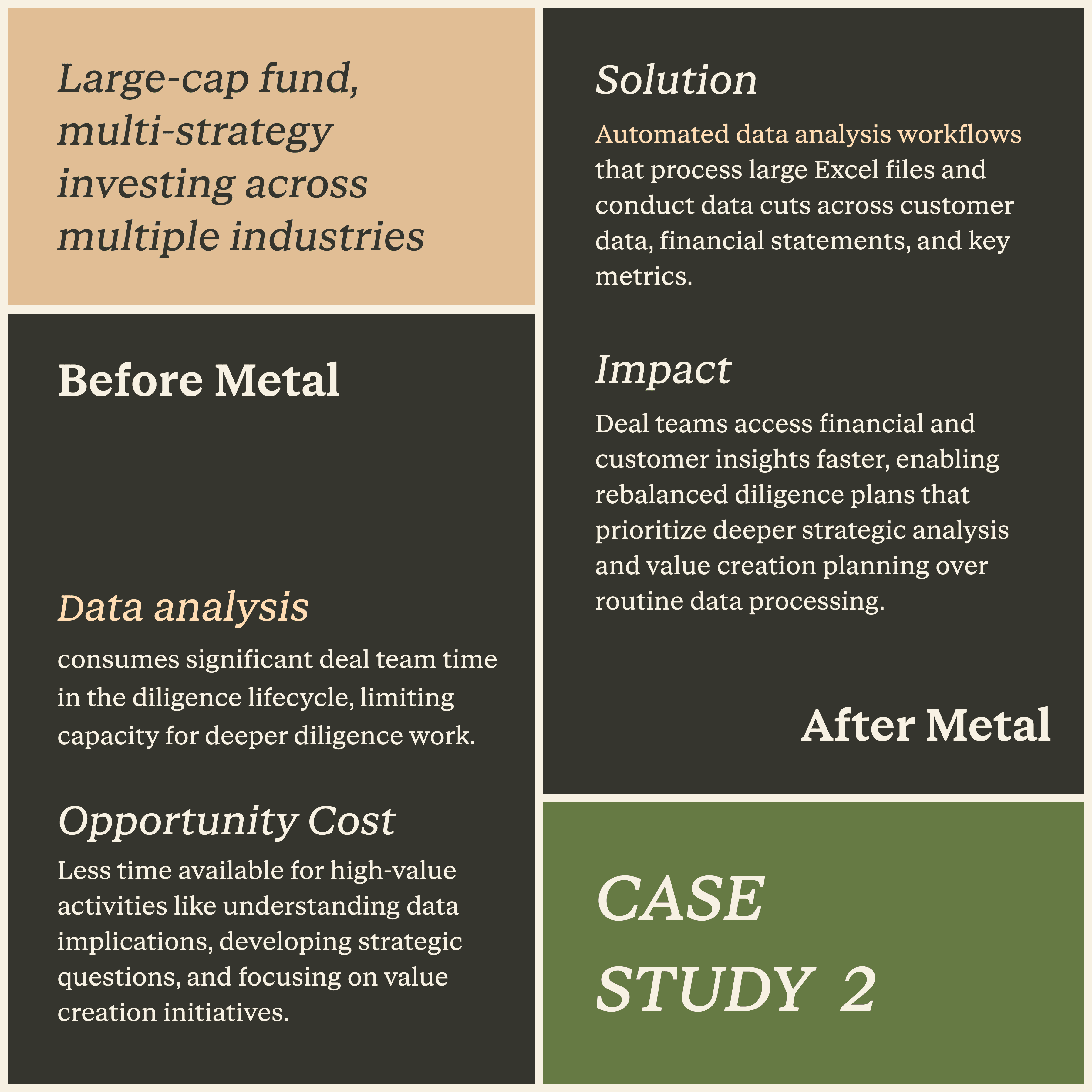

Case 2: Multi-Strategy PE Fund Transforms Data Analysis Workflows to Prioritize Strategic Value Creation

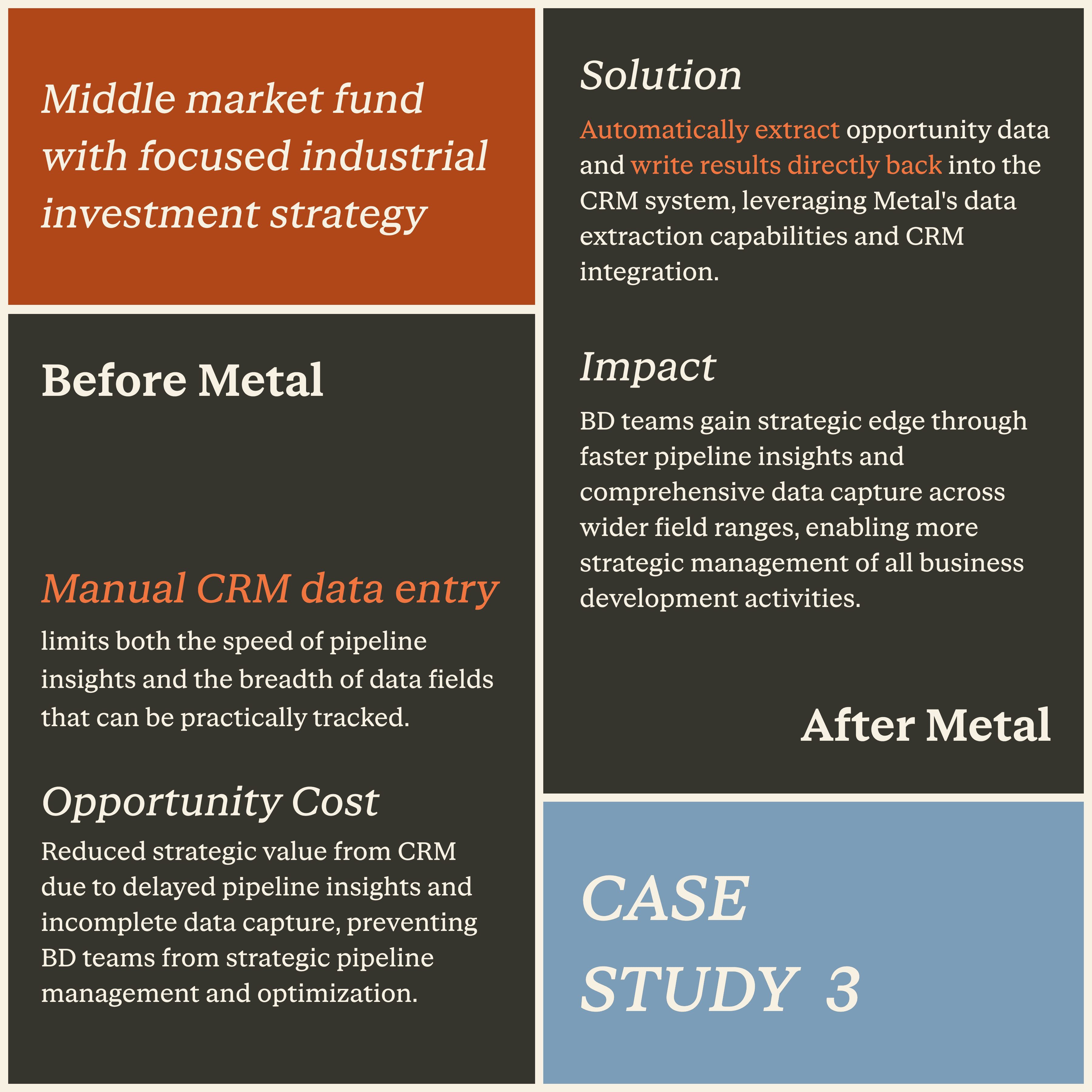

Case 3: Industrial-Focused Fund Automated CRM Workflows for Enhanced Pipeline Intelligence and Strategic BD Operations

What Makes Metal’s Partnership Model Different

Embedded from Day One: Partnership begins with comprehensive discovery into your fund’s investment objectives, existing workflows, and critical data sets and data sources. We define core objectives, prioritize use cases, and establish success metrics that matter to your investment committee.

Hands-On Enablement: We provide complete training and ongoing support throughout our partnership at no additional cost, configuring the platform to fund-specific workflows and ensuring broad team adoption from analysts to managing directors.

Continuous Alignment: We host regular strategic reviews with fund leadership to identify new opportunities, refine existing workflows, and incorporate advancing AI capabilities. The platform grows more valuable over time as institutional knowledge accumulates.

Custom Workflows: Pioneering funds work with us as innovation partners. Using Metal’s platform, we co-create custom workflows that address their specific diligence requirements and investment processes. See how this partnership approach delivered results in our Berkshire Partners case study.

The Platform as a Living Framework

Metal isn’t static software. It evolves with your fund.

Through hands-on enablement, the platform rapidly becomes both a system of record and a system of action.

System of record: It aggregates data across your complete investment history from multiple sources, including CRMs, repositories, deal documents, expert calls, and financial statements, creating a dynamic, living library of institutional knowledge.

System of action: With comprehensive deal data accessible across your investment team, Metal powers high-impact private equity workflows throughout the entire due diligence process.

Our AI-driven platform generates industry research reports during thematic analysis, identifies high-value investment targets using aggregated screening criteria and expert call insights, and provides instant analysis of key diligence topics when uploaded against virtual data rooms.

The result: a continuously improving private equity intelligence framework where institutional knowledge, investment processes, and AI capabilities evolve together to drive sustained edge in deal sourcing and evaluation.

Partnership as a Strategic Advantage

Funds that prioritize institutional intelligence over generic AI will establish lasting competitive advantages for the next decade. Choosing Metal means gaining a committed technology partner invested in your long-term success, not just your annual contract.

Our partnership model has consistently delivered measurable results: faster deal processes, broader team adoption, and operational value that compounds over time. More importantly, it positions your fund at the forefront of AI adoption.

Connect with our team to discuss how Metal can unlock AI's full potential for your investment strategy.