Dec 17, 2025

Metal vs. ChatGPT: Why System of Record Beats Point Solutions

Taylor Lowe

OpenAI's new SharePoint connector for ChatGPT marks a step forward. Private Equity deal teams can now query firm documents without leaving their chat interface. It's more powerful than before.

But how does it compare to a platform purpose-built for private equity? One that understands PE language, your investment frameworks, automates diligence workflows, and embeds your firm's deal history from the ground up?

Same Question, Different Depth

Nothing makes the distinction clearer than a side-by-side test. Same SharePoint integration, same access to financial filings, same analytical question.

Note: The example below uses publicly available PowerSchool 10-K and 10-Q filings for illustration purposes only. No actual deal information is referenced.

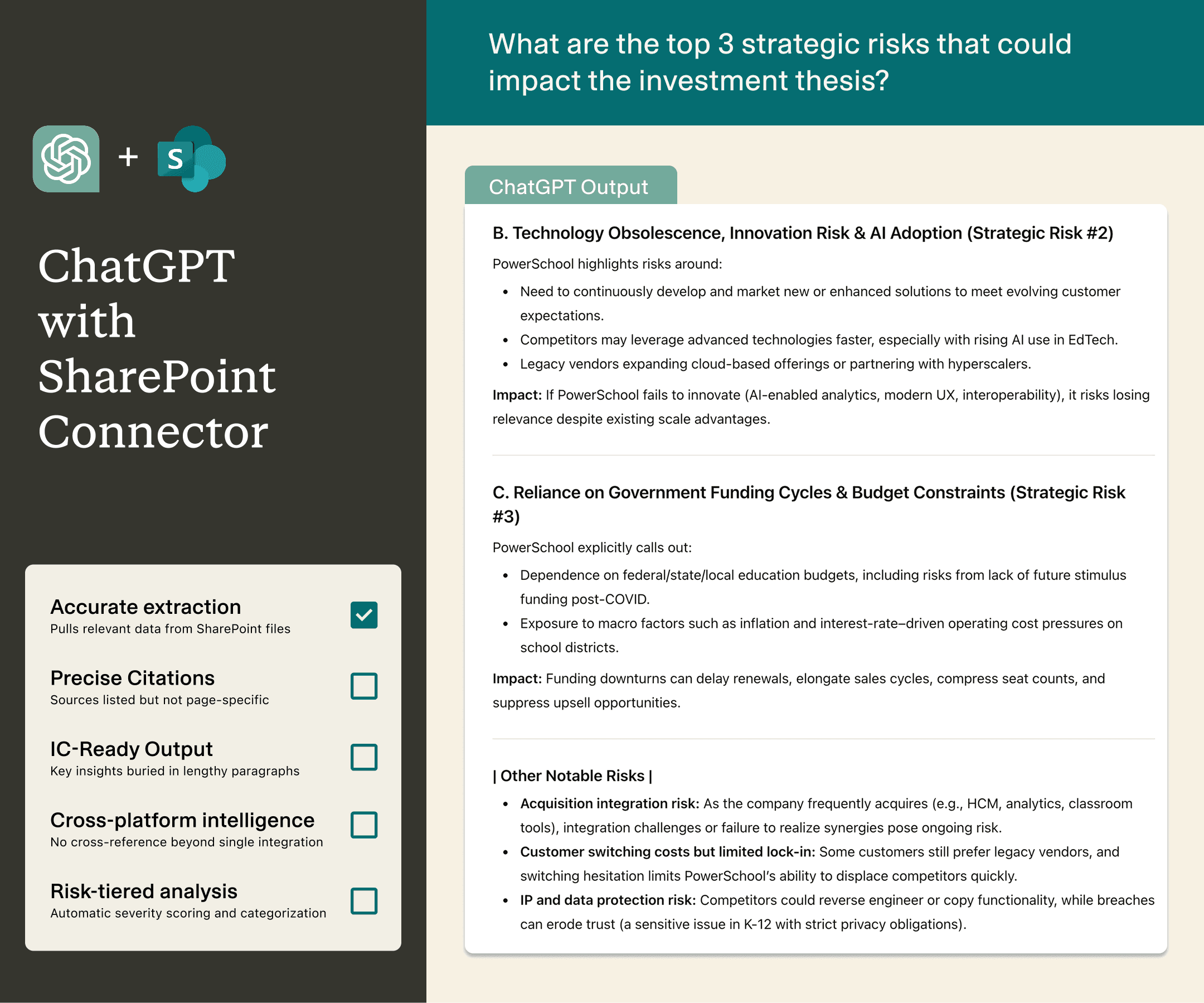

ChatGPT with SharePoint Connector

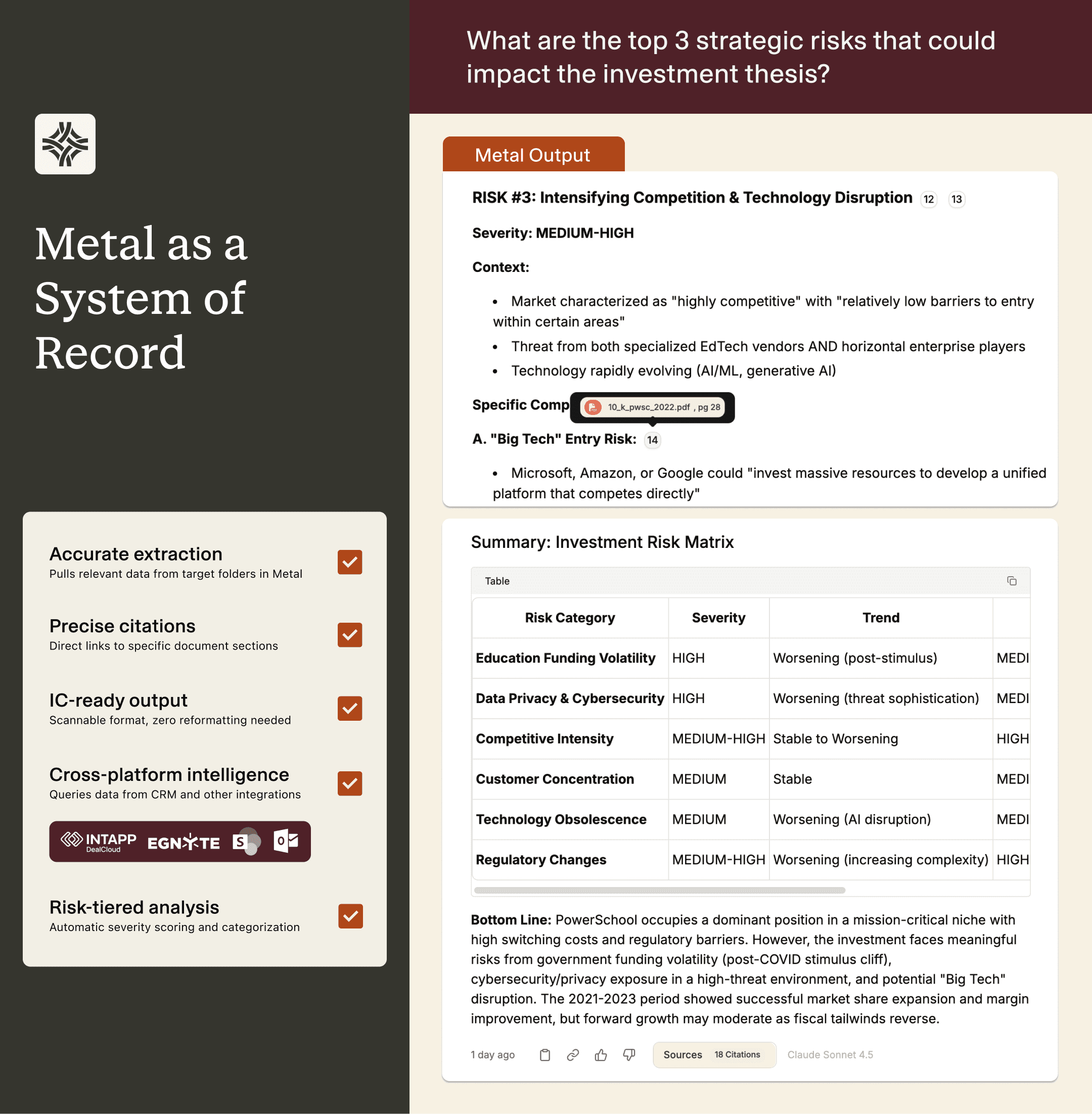

Metal as PE firm’s System of Record

Side-by-Side: What You Get with Each Platform

The gap becomes immediately visible:

ChatGPT shows you what's in specific files, achieves accuracy but limits analytical depth.

Metal's institutional intelligence delivers actionable insights that match your firm’s risk framework. It reveals patterns visible only through your firm's investment history—showing you how this opportunity compares to past deals, where similar risks emerged, and what actions proved effective.

ChatGPT + SharePoint | Metal | |

|---|---|---|

Data Access & Quality |

|

|

Analysis & Structure |

|

|

Collaboration & Action |

|

|

The System of Record Advantage: Why Infrastructure Determines Analytical Depth

The difference isn't just features. It's infrastructure. ChatGPT with SharePoint remains a point solution where you can access your document repository, and chat with specific files in isolated sessions.

Metal operates as a system of record where you chat with institutional intelligence that spans data sources, preserves context, and connects dots across your entire investment history:

Internal repositories: SharePoint, Egnyte

CRM systems: DealCloud, Salesforce

Communication platforms: Outlook, email archives

Market intelligence: PitchBook, third-party data providers, web search

Deal artifacts: Expert calls, financial models, VDR documents,etc

We often hear from our clients:

How do I know the data I leverage is the right data?

When you ask Metal about a target company's competitive positioning, it doesn't just read the CIM. It can cross-references similar deals in your DealCloud pipeline, pulls comparable transactions from PitchBook, surfaces relevant expert call insights from past diligence, and benchmarks financial metrics against your portfolio companies in the same subsector.

More critically, every insight includes precise source verification—click through to the exact page and section where the data originated, eliminating the AI hallucination risk that undermines trust in generic tools.

On ChatGPT? Source citations drop you at page 1 of the 100-page full document—you're on your own from there.

From Analysis to Action: The AI Custom Workflow Gap

Even if ChatGPT could match Metal's analytical depth (it can't, because it lacks the data infrastructure), it stops at insight generation. Metal connects insights to execution by supporting AI custom workflows for private equity.

After analyzing a target company in Metal, you can:

Update opportunity scores which syncs to DealCloud automatically

Generate investment memos using your firm's approved templates

Schedule management meetings through Metal’s Outlook integration

Pull comparable transactions for IC preparation

Export structured analysis for team collaboration

Your diligence process doesn't pause for manual data transfer between systems. Intelligence flows directly into action.

The Evolution of AI solutions for Private Equity

The shift from ChatGPT to Metal mirrors a broader evolution in how private equity firms approach AI: from viewing it as a productivity tool for individual tasks to recognizing it as institutional infrastructure that captures and scales investment expertise.

McKinsey's latest survey on agentic AI reinforces what we're seeing:

The real competitive advantage comes from AI systems that operate as institutional systems of record that are designed for scale and growth.

80% of organizations set efficiency as an AI objective, but the companies seeing the most value also prioritize growth and innovation.”

High-performance winners redesign workflows while experimenters just automate them.

Half of AI high performers intend to use AI to transform their businesses, and most are actively redesigning workflows rather than bolting AI onto existing processes.

That's the fundamental difference between asking ChatGPT to read a document and asking Metal to contextualize an opportunity against your firm's decade of deal history.

For private equity deal teams evaluating AI platforms, the choice comes down to breadth versus depth. Funds that treat AI as "better search" will get incremental efficiency gains. Funds that build institutional intelligence will create compounding competitive advantages.

Discover how Metal partner with top PE funds

Read: What private markets should know about agentic AI adoption